Table of Content

Have you ever felt like there’s something more to life than what we’re already doing? Have you wanted to leave a lasting mark on the world and build something that people talk about for generations? If this sounds like your call, then it’s time to find out your purpose and set up a business that can bring financial freedom. In this blog post, I will be talking about how one can create an everlasting financial legacy with careful planning and successful implementation. We’ll look into various topics such as constructing a strong wealth foundation, finding our own purposeful companies, achieving financial independence, building legacies lastingly, and proper estate preparation. So let us take each step necessary to produce our very own legacies!

Discovering Purpose in a Purposeful Business

Launching a business can be an amazingly satisfying yet hard journey. It takes oodles of passion, zest, and devotion to make your own successful organization from the ground up. But even more than that, it needs purpose. The reality is that if you don’t uncover your underlying reason for doing this endeavor and accept it heartily, then building a thriving company won’t last in the long run! It sounds really overwhelming, but fortunately, finding out what fulfills you with regards to having an intent-driven enterprise isn’t as difficult as it looks! is to make a commitment to yourself that you’ll never give up. You can also remind yourself of why you’re doing this in the first place—because it brings joy and fulfillment, not only for your customers but for your business too! (SBA – start your business)

Having clarity around our true purpose when making decisions about our businesses is essential if we want success. We must ask ourselves what makes us unique before deciding on which products or services we should offer. This helps ensure that everything will remain aligned with our core values to deliver value and fulfill our financial legacy along the way. It’s inevitable that there will be tough times throughout any journey; however staying motivated during these moments is paramount – an important reminder being asking oneself ‘Why am I doing this?’. Holding onto the thought of providing not just satisfaction from customers but personal gratification keeps one going through such hardships; never giving up until the desired outcome has been achieved!

Whenever things start to feel overwhelming, it’s important to be able to draw on power affirmations about what makes your financial legacy so meaningful. For me, that affirmation is: “I have the resilience and ability to turn my dreams into reality and make a lasting impact on people’s lives.” Whenever I’m falling down or feeling discouraged in business, I refer back to this mantra for motivation!

Allowing myself permission to take risks and explore new ideas without worrying about other people’s approval has been huge for me when building my financial legacy. It doesn’t matter if others don’t think it’s conventional; as long as you’re resonating with an idea, exploring further could pay off big time!

Building a Business for Financial Freedom

Creating a successful business for financial freedom can be overwhelming. There is no ultimate roadmap to success in entrepreneurship; however, it’s possible to build an enterprise that’ll provide you and your family with the economic independence you seek. To achieve this goal, start by figuring out what exactly your objectives are. What do you hope to accomplish? Where would you like yourself to be five years from now? (Entrepreneurship)

Once you’ve answered these questions, it’s important to start forming a plan for your business. It should include the direction and goals of what the company is going to be like in the future, as well as specific actions that need to take place in order to make them happen. You will have to consider how much money is needed at the beginning stage as well. This can come from private sources or investors but whatever route you choose, having enough cash flow to get things up and running is essential!

Now you have to research and create a successful marketing plan that explains why customers should select your product or service instead of other competitors in the market. Furthermore, identify who comprises your target group so you can mainly provide solutions that fit their requirements. Besides, consider picking an individual area that sets you apart from others in this business and building associations with those who can help sustain and propel forward your brand name. Finally, come up with approaches for setting systems that enable yourself as well as anyone else within the organization to operate more efficiently, thus everyone gains an advantage—both financially and mentally—out of it.

This could mean applying software tools such as CRM (customer relationship management) advice services or HR (human resources) support programs, depending on what kind of company structure has been truly selected by yours. With proper measures taken care of, constructing a firm aimed at financial indulgence becomes much smoother! (Entrepreneur – Financial Freedom)

The Journey to Financial Legacy

Journeying toward a financial legacy is no easy feat. It takes serious commitment and hard work to craft a successful and profitable business that can persist through the generations. This process demands patience, time, unwavering dedication, and intense concentration if you want your dream to come true. However, with enough determination matched with the necessary effort on your part, you may be able to produce something that will bring security as well as emotional stability for many years ahead of us.

One of the most important phases of this journey is finding out what really matters—discovering our purpose. Why are we here? What do we wish to achieve by building these businesses? These essential questions define who we are and help distinguish between success and failure so it’s critical to take some time off to oxygenate ourselves before making any progress!

Having a clear understanding of why you’re doing this will be a great help when things get difficult or seem too complex. Ask yourself: What is it that’s motivating me to build an effective business? Is it for some sort of personal realization I’m looking for, or do I want financial independence? What kind of mark am I hoping to leave behind in the world? Knowing your purpose can support and inform each decision you make while keeping your direction pointed toward success.

In addition to discovering that ‘why’, formulating a plan before starting (or continuing) along your journey is also essential to achieving success. Coming up with specific steps as well as having clarity about what achievement looks like will provide structure and direction, which ultimately leads to staying energized throughout the process. With sufficient planning, exploring data points carefully, making strategic decisions, being disciplined diligently, and sticking unwaveringly by these values, then creating a long-term monetary legacy would become achievable!

Engaging in Legacy Building and Planning

Creating a legacy can feel like an intimidating mission—something that only the affluent or successful can do. But everyone has a mark they’d want to leave behind—their own set of values, morals, and life lessons for future generations. The real challenge is figuring out what this legacy should look like and how one could create it! Building your legacy doesn’t necessarily require too much complexity; begin by taking into consideration your current situation in life, including any existing difficulties you might face as well as all the success stories you have already accomplished so far. Have you achieved anything significant? Are there professional goals yet unfulfilled? Or maybe just take time to recognize who matters in your everyday existence: friends, family members, or even mentors from whom you’ve learned valuable principles while being together. All these questions need consideration when building up one’s lifetime record! (Forbes – Legacy Planning)

I often think about the kind of legacy I’d like to leave behind. It could be something as simple as teaching my kids and grandkids crucial life lessons or even just living a more mindful lifestyle. But it might also involve me leaving something tangible, such as starting a business that will go on long after I’m gone. You know what they say: when you teach someone how to fish rather than giving them one, your impact will last for much longer! Legacy building isn’t only concerned with money; it’s all about creating something lasting beyond our lifetimes, an influence we can have on future generations down the line.

Once you have identified the kind of legacy you want to leave, it’s time to start taking steps toward achieving that goal. Begin by setting financial goals and building relationships with mentors who are experienced in your field or start a new one if you don’t already have one. Work hard and strive for perfection, as this will help create an impactful legacy over time. Invest some of your resources into giving back to the community too; it’ll be beneficial not just now but also long after we’re gone! Legacy planning is integral when talking about financial freedom (Inc – Financial Freedom) because whatever wealth we accumulate in life won’t go away post-death; instead, our loved ones can benefit from it even after we die. So take some time today and think about what kind of meaningful imprint you would like to leave on earth before departing.

Steps to Establishing a Lasting Financial Legacy

Creating a financial legacy isn’t just about filing tax returns or making a retirement fund; it’s even more than that. It can be viewed as uncovering your purpose and forming the basis for generations to come by using investments correctly. To get started with this effort, here are a few steps one must take: Firstly, define what you want to achieve by creating such a legacy. Do you have any clear goals? What kind of inheritance would you leave behind? How much money is required to reach those targets? And how long will it take before they’re met? Once these questions are satisfactorily answered, then it’s time to go ahead full steam!

Creating a sound financial plan for your life is essential to ensuring you have the security and stability necessary to invest in yourself and those around ya. A crucial part of this plan should comprise how much money you’ll be investing each month or year as well as when you want to start receiving income from all these investments after death, if at all. Once the planning has been done properly, it’s time to get started with active investment! (The Balance – Financial Planning)

The next step would be earning passive income. Passive sources like dividend stocks, real estate-related assets, and peer-to-peer lending can offer a regular flow of money over many years, even beyond one’s lifetime. Wouldn’t that just make an amazing legacy?

When it comes to building lasting financial freedom, considering long-term strategies is essential. One such option includes investing in private equity funds or venture capital investments that offer potentially promising returns but have more risk factors attached. A key point here is to diversify your portfolio while reaping rewards from successful investments and at the same time minimizing potential losses too—a tricky balance indeed! Another suggestion could be setting up something tangible for future generations, like purchasing life insurance policies or college savings accounts for children or grandchildren, as this will ensure their well-being even after you’re gone. But if cost constraints are an issue, then why not try leaving behind something less physical yet equally impactful by sharing knowledge through books, articles, videos, etc.?

These educational tools can have far-reaching consequences beyond just monetary ones! And lastly (but definitely one of the most important parts), remember to show gratitude today for what you’re ultimately working towards: true financial independence where resources aren’t necessary anymore; planning ahead and making wise decisions now pave the way for achieving this dream eventually so cherish every milestone along the journey, no matter how small they might seem initially!

In conclusion, legacy building and planning are invaluable resources for attaining financial freedom. Finding your purpose in life, establishing internal objectives, and constructing a much-admired business can all be key components of creating an enduring financial legacy. Getting to the point where you feel financially independent requires strategic thinking. By utilizing these go-to tools effectively now, you’ll be on your way to leaving behind something that will stay with generations down the line. What could make it more worthwhile?

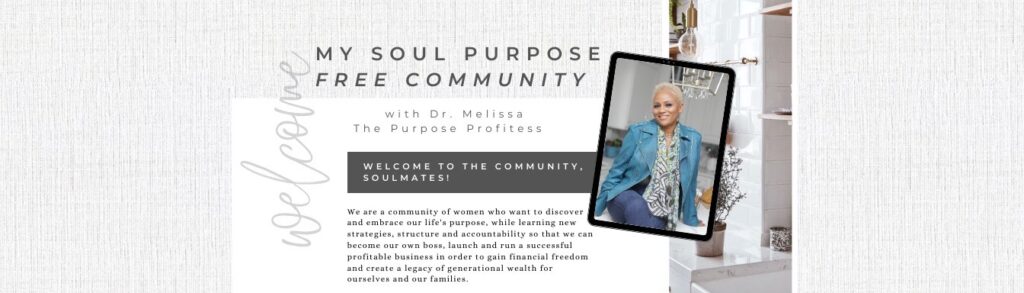

Are you ready to make a giant leap in your journey towards self-fulfillment? Join the My Soul Purpose Community and open yourself up for experiences with like-minded people who are ambitious about living their best life. In this community, we can help each other learn and grow into our ideal versions of ourselves! With plenty of courses available, group workshops, webinars, and meditations, all that good stuff helps us gain the courage to reach new heights! From creating resilience within ourselves to forming positive lifestyle habits that will stay with us forever, let’s unlock all those hidden talents inside us! Let’s build an invincible bond between individuals seeking inner joy by inspiring one another through passionate instructors as well as empowered peers. Let’s create something marvelous together –